With the help of this blog you will learn what is section 43B(h) , applicability, time limit of 15/45 days for payment to msme ,penalty in case of non payment, complete understanding with practical example and a readily available check list for this section. Blog also covers the FAQ on the applicability of the section and time limit for payment for better understanding of the concept

What is section 43B(h)?

The Finance Act 2023 inserted Section 43B(h), according to which any amount payable to Micro & Small Enterprises (MSME) for goods or services received from them can be claimed as deduction in the same year if the actual payment is made within the timelines mentioned by the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006.

Applicability of Section 43B(h)?

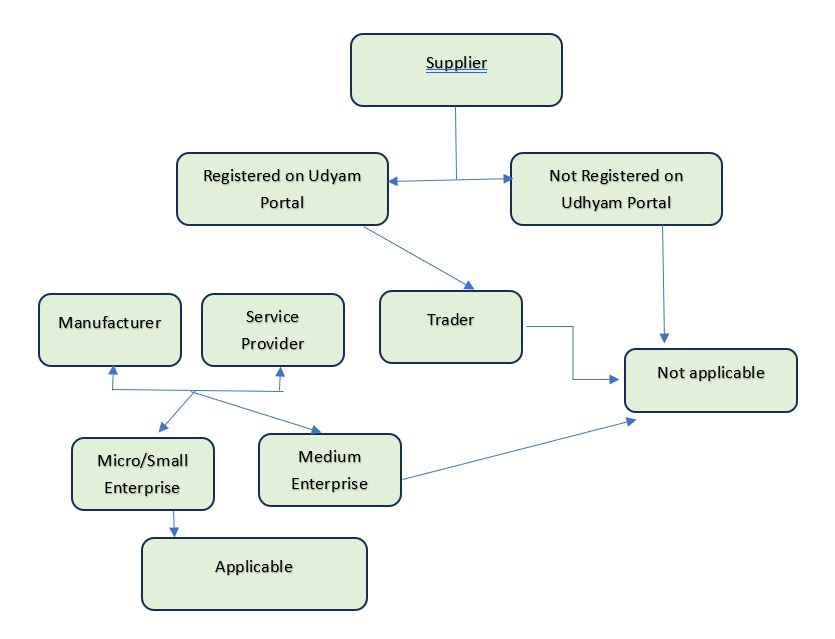

This section is applicable only when an enterprise (either manufacturer, trader, service provider) is buying goods or taking services from an entity (manufacturer & service provider only traders not covered) registered under the MSMED Act, 2006 as micro & small enterprises. This section is not applicable to medium enterprises registered under the MSMED Act,2006.

FAQ on Applicability of Section 43B(h)

1. Who are micro & small enterprises?

| Micro & Small Enterprise | ||

| Type of Enterprise | Turnover* | Investment in Plant & Machinery |

| Micro Enterprise | ≤ 5 Crore | ≤ 1 Crore |

| Small Enterprise | ≤ 50 Crore | ≤ 10 Crore |

*Turnover does not include export turnover

2. Whose registration to be checked under MSMED act whether supplier or buyer?

Registration needs to be checked for the supplier who supplied the goods & services to us. Buyer can be registered or not.

3. How to check whether supplier is registered or not?

We can ask for the UDHYAM Registration Certificate from the supplier which is the certificate of registration under MSMED Act.

4. Whether traders who are registered under MSMED Act, 2006 are covered under this 43B(h) section?

Only manufacture suppliers & service suppliers who are registered are covered under this section. Trader supplier even when registered under the MSME act are not covered under this section. So even they are registered they are not covered under this act.

5. From which year this section is applicable?

This section is applicable from FY 2023-2024

6. Whether this section is applicable on the amount outstanding prior to 1.04.2023?

No the amount outstanding prior to 1.4.2023 are not covered under this section. Only the amount spent in FY 2023-24 and ownwards are covered under this section

7. Whether it is applicable on Capital Expenditure?

No, 43B(h) section is not applicable on capital expenditure as they are not the part of profit & loss account

8. Whether it is applicable on Enterprises paying tax on presumptive basis?

No, this section is not applicable on enterprises opting for paying tax on presumptive basis.

9. Whether 43B(h) is applicable on all the expenses incurred in the financial Year?

No, it is applicable only on the expenses whose balances is outstanding on March 31.It means you can make the payment anytime during the FY if there balance is not going to outstanding on March 31st.

10. Whether the payment once disallowed under section 43B(h) will never be allowed?

It will be allowed in the year when you make the payment to supplier.

Time Limit to make payment to MSME under Section 43B(h)

Written Agreement Exists: If there is written agreement enterprises are required to pay MSMEs within agreed timelines not exceeding 45 days, as per section 15 of the MSMED Act, 2006.

Written Agreement does not Exists: In the absence of a written agreement, payment should be made within 15 days.

FAQ on Time Limit on payment to MSME

1. How to calculate the limit of 15/45 days for the payment to msme enterprises?

In case of Written agreement: Period of 45 days will be counted from acceptance or presumed acceptance of products or services or the period agreed upon in writing between buyer and supplier.

In case of No agreement: Period of 15 days will be calculated from date of delivery of product or services.

2. In case of any dispute from where the respective days will be calculated?

In case there is any dispute between supplier and buyer and written communication is made with in 15 days period in case of no agreement then 15 days period will be calculated from the date of resolve of dispute otherwise if written communication is not made time period will be calculated from delievery of goods.

Penalties for Failure to Pay MSMEs Within the Time Frame

Expenses Disallowed under Income Tax Act:- In case payment is not made with in the prescribed time frame ,then the outstanding amount as on March 31 will be added to your taxable income & assessee has to bear the burden of tax liability. The auditor will report it in his tax audit report. The assesse will get the deduction only in year of payment of outstanding amount.

Interest @ 3 times the RBI Rate :- Interest has to be paid monthly to supplier @ 3 times the bank interest notified by the RBI. Interest is payable from the due date of payment or date mentioned in the agreement.

Disallowance of Interest:- Interest which has been paid to msme due to non payment is also not a allowable expense under section 37 as per income tax act as it is in the nature of penal interest.

Practical Example on which year you will get Deduction in multiple scenerios

| S. No. | Date of Purchase | Agreement Availability | Appointed Date of Payment | Actual Date of payment | Deduction allowed in FY |

| 1 | 01/05/2023 | No | 16/05/2023 | 30/05/2023 | FY 2023-24 |

| 2 | 01/05/2023 | Yes | 15/06/2023 | 30/05/2023 | FY 2023-24 |

| 3 | 01/05/2023 | Yes | 15/06/2023 | 30/08/2023 | FY 2023-24 |

| 4 | 19/02/2024 | No | 04/03/2024 | 30/03/2024 | FY 2023-24 |

| 5 | 19/02/2024 | No | 04/03/2024 | 2/04/2024 | FY 2024-25 |

| 6 | 19/02/2024 | Yes | 04/04/2024 | 01/04/2024 | FY 2023-24 |

| 7 | 19/02/2024 | Yes | 04/04/2024 | 19/04/2024 | FY 2024-25 |

Ready to do check List to ensure Compliance with the section

- Make a list of all of your suppliers whose balance is outstanding on March 31

- Request for a declaration from them that they are registered under MSME and also request them to provide us with their Udhyam Certificate

- Now differentiate the supplier on the basis of information on Udhyam Certificate and create a list for micro and small manufacturer or service providers as 43B(h) is applicable to them only.

- Enter into an agreement with them to get the benefit of extended period of 45 days

- Clear all the outstandings with in the timeline to avoid the penalty mentioned above.

-

Previous Post

Old vs New Tax Regime: Which is better Old or New?

Support

Support